📌 Company Overview

Great Eastern Shipping Company Ltd. (GESCO) stands tall as India’s largest private-sector shipping firm. It operates through:

Shipping Division: Tankers, dry bulk carriers, LPG vessels

Offshore Division: Oilfield services via Greatship India (rigs, platform supply vessels)

The company commands a fleet of 38 owned ships and 2 chartered vessels, with a market capitalization of ₹14,000 Cr, and a proven track record in capital discipline.

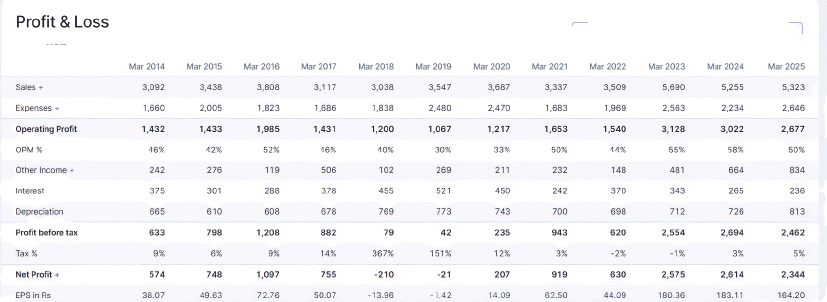

📊 Financial Snapshot (FY21–FY25)

Takeaway: GESCO has maintained healthy margins, robust profitability, and strong capital efficiency, even as industry cycles shift.

🧾 Quarterly Performance (FY26 – Projections)

Q1 FY26:

Revenue: ₹1,223 Cr and Net Profit: ₹363 Cr with OPM of: 40%

Q2 FY26:

Revenue: ₹1,354 Cr and Net Profit: ₹576 Cr with OPM of: 48.26%

Insight: After a Q1 drop, performance is recovering with stable margins and improved fleet utilization.

🛠️ Recent Developments

Fleet Actions: Sold aging ship Jag Rishi, maintaining 38 vessels and avoiding overexpansion.

Offshore Bookings: 80% rigs booked for FY26; secured long-term ONGC contract.

Capital Strategy: Redeemed ₹400 Cr NCDs; cash reserves at ₹5,372 Cr.

Dividend: Interim ₹5.40 in Q4 FY25 — 13th straight quarterly dividend.

💸 Valuation Metrics (June 2025)

GESCO, with a trailing P/E ratio of 5.67—significantly below the sector average of 10x indicating strong value appeal. The stock’s P/B ratio stands at 1.0, while EV/EBITDA is around 3x, highlighting operational efficiency.

It offers an attractive dividend yield of 4.5% and a robust cash flow from operations yield between 10–15%. The intrinsic value is estimated at ₹972.75, suggesting the stock is undervalued by 26%, and it currently trades almost 40% below its Net Asset Value. Overall, GESCO presents a compelling case for income-focused and value investors, with its undervaluation driven more by cyclical market sentiment than by fundamental weakness.

🔍 SWOT Summary

✅ Strengths

Diversified fleet across tankers, dry bulk, LPG, and offshore

Strong liquidity with cash reserves of ₹5,372 Cr

Debt-light balance sheet (D/E ratio of 0.15)

Consistent dividend record and high solvency rating

⚠️ Weaknesses

Declining operating margins (from 57.5% to 50.3% in FY25)

Higher working capital days (from 28 to 182)

Portions of fleet aging, raising operational costs

🚀 Opportunities

Offshore rig demand rebound, especially post-monsoon

ESG upgrades and fleet retrofitting aligned with IMO mandates

Growing need for energy-efficient shipping solutions

🔻 Threats

Geopolitical instability (e.g., Red Sea crisis)

Regulatory risks from IMO 2023/2030 mandates

Asset value corrections if freight rates soften further

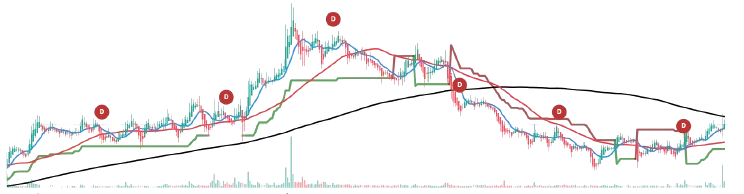

For long-term investors, Great Eastern Shipping presents an attractive opportunity to accumulate, given its undervaluation and steady dividend history, making it a solid candidate for portfolios focused on stability and capital appreciation over time. Dividend-focused investors may find value in simply holding their positions to benefit from the company’s consistent quarterly payouts and shareholder-friendly policies. Meanwhile, short-term traders may wait until a decisive breakout is observed, which could signal renewed momentum and a favorable technical entry point. Ultimately, investment decisions should align with one’s risk appetite and market outlook in a cyclical sector like shipping.

📬 Disclaimer

This analysis is for educational and informational purposes only and does not constitute financial advice. All data is sourced from public company filings, analyst reports, and third-party sources believed to be reliable. In line with SEBI’s guidelines, all market data is presented with a three-month lag. Investors should carry out their own due diligence and consult the financial advisor before making any investment decisions. The views expressed are personal and may be subject to errors or bias.

🗣️ Let’s Talk

💬 Do you think GESCO’s discounted valuation makes it a hidden gem in the shipping space?

🌊 Can its strong balance sheet and offshore strategy help it weather global trade volatility?

📩 Write to us or share your views below. We’d love to hear your take!