Welcome to the latest edition of our investment newsletter, where we explored the potential and investing in BSE Ltd shares at ₹4,100 as of March 11, 2025, during a sharp correction in the stock and broader market. Despite a high-risk environment, several compelling factors made BSE an attractive opportunity for me/us with a contrarian approach.

We also run a small WhatsApp group where the esteemed members regularly discuss strategies, stock selections, market movements, and related topics. In this instance, one of our esteemed members and close friend, questioned the rationale for entering BSE when there were no signs of immediate recovery. That led to an in-depth discussion where I shared why I took this contrarian stance.

Below, I outline the key reasons behind this investment decision, based on recent financials, market dynamics, and strategic developments.

Why Consider BSE at 4,100?

Discounted Entry Point

A market crash often results in stocks trading below their intrinsic value. At ₹4,100, BSE shares were significantly off their 52-week high, presenting a potential bargain. This lower price may offer substantial upside if the market stabilizes and sentiment recovers.

Robust Financial Performance

In FY2025, BSE posted remarkable growth, with revenue reaching ₹3,212 crore—up 100% year-on-year. Net profit stood at ₹1,322 crore, a significant rise from ₹772 crore the previous year. In Q4 FY25 alone, net profit surged to ₹494 crore, compared to ₹107 crore in Q4 FY24. These figures underscore BSE’s strong fundamentals and its capacity to rebound once market conditions improve.

Debt-Free and High ROE

BSE has maintained a zero-debt position for the past five years, minimizing financial risk. Its impressive Return on Equity and Return on Capital Employed highlight efficient capital utilization, contributing to its resilience during volatile periods.

BONUS DECLARATION WAS EXPECTED BUT THERE WAS NO INTIMATION, CLUE OR DISCUSSION AT THE MOMENT

Growing Derivatives Market Share

While NSE continues to dominate, BSE’s index options premium market share climbed from 16% in December 2024 to 23% in April 2025. A key driver of this growth was the strategic decision to shift the expiry day. This expansion not only enhances its revenue stability but also aligns with trends favoring derivatives trading during market turbulence.

Long-Term Growth Potential

BSE has consistently delivered strong returns in previous years. Its diverse revenue streams—including transaction charges, corporate services, and treasury income—along with platforms like BSE SME and BSE StAR MF, position the company well to benefit from India's deepening capital markets. Increasing retail participation and digital penetration further strengthen its growth prospects.

Analyst Confidence

Analysts remain bullish on BSE, maintaining a “Buy” rating and revising FY26/27 earnings estimates upward by 7–13%. These revisions reflect confidence in sustained options volume and a target PE that points toward strong recovery potential.

Counter-Cyclical Advantage

As a stock exchange platform, BSE benefits from increased trading volumes during volatile times. Even amid downturns, heightened activity can boost transaction revenue, making it less susceptible to economic cycles compared to other sectors.

Contrarian Opportunity

Market crashes often stem from panic rather than fundamentals. Buying BSE at ₹4,100 aligns with the adage, “Be greedy when others are fearful.” If the decline is sentiment-driven, a rebound could be swift and significant.

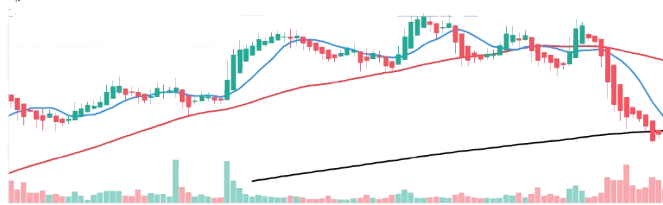

At this price point, BSE was holding above its 200-day Simple Moving Average, supported by a favorable Relative Strength Index and increasing volumes. Historically, BSE has respected this support level, giving me confidence in a potential reversal.

There were several key risks to weigh, but acting on conviction remains a cornerstone of successful investing.

Investment Takeaway

Purchasing BSE Ltd during a market correction presented a unique opportunity for long-term, medium-term, and even short-term investors with a high-risk appetite. The blend of a discounted entry price, strong financial performance, and rising market share made BSE a compelling contrarian bet.

Action Steps:

Evaluate your risk appetite and investment horizon

Diversify your portfolio to cushion against market volatility

Track technical indicators like support, RSI, volume trends, and historical price zones

Always consult a certified financial advisor to align investments with your financial goals

Disclaimer: Though we are sitting on the remarkable gains, but investing in stocks carries inherent risks, which can be amplified during market crashes. This article is intended solely for informational purposes only and should not be considered as a financial advice. Conduct your own due diligence and consult with a certified financial advisor before making any investment decisions.

💬 Let’s Talk

I’d love to hear your thoughts:

Would you have entered BSE India during the crash?

Do you agree with this contrarian bet—or would you have waited?

What other stocks seem mispriced in today’s volatile environment?

Reply with your take, counterpoint, or strategy. Let’s start a conversation!