📅 The Strategic Buy — May 19, 2025

On May 19, 2025, I made a calculated investment in Astral Ltd. at ₹1,410. This decision was anchored in a powerful combination of technical breakout signals, strong fundamentals, and long-term growth prospects in India’s surging construction and infrastructure sectors.

Astral — a leader in CPVC/PVC pipes and adhesives — emerged as a high-potential play for value creation. Below, I break down the key reasons behind this investment and the broader market dynamics that support it.

📊 A Well-Timed Technical Breakout

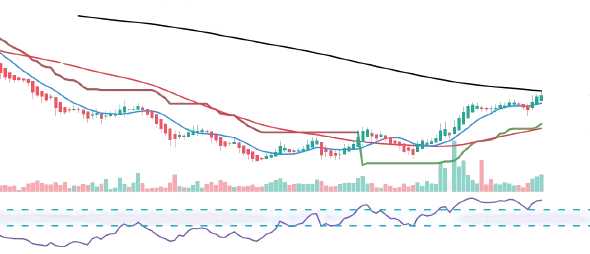

Triple Bottom Formation: The stock formed a strong base near its 52-week low of ₹1,232, signaling a potential reversal from its steep 50% fall from the July 2024 peak of ₹2,454.

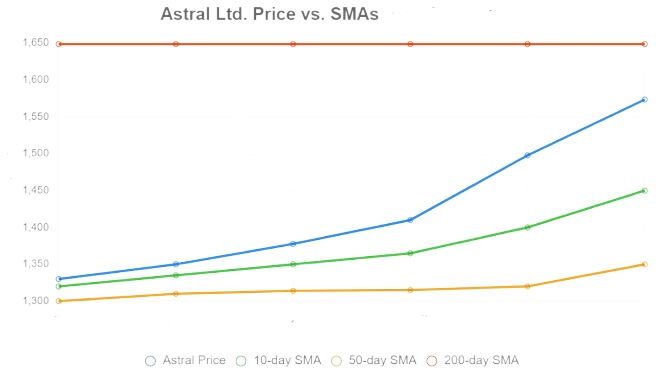

Breakout Confirmation: By May 19, Astral traded above its 10-day and 50-day SMAs and approaching 200 days, indicating renewed short- to medium-term strength.

Volume Surge: A spike in volume — particularly between ₹1,330 and ₹1,425 — confirmed buying interest and institutional accumulation.

RSI Momentum: The Relative Strength Index hovered between 65–70, showing bullish momentum just shy of overbought levels.

Super Trend Alignment: Technical indicators, including the Super Trend, reinforced a likely short-term uptrend, making ₹1,410 an attractive entry point.

📈 Fundamental Strength & Market Leadership

Astral’s fundamentals made a strong case for long-term growth:

Market Leadership: Dominant player in the CPVC/PVC pipe segment with a solid balance sheet and minimal debt.

Product Innovation: Continued focus on high-margin, value-added products like silent drainage systems and fire-resistant pipes.

Strategic Acquisitions: Acquisitions of AL-AZIZ Plastics, 80% of Seal IT Services and 76% of Resinova Chemie diversify the portfolio into adhesives, paints, and gas/water pipe systems.

Adhesive Growth: Adhesive business alone surged 14.5% YoY to ₹1,098 crore, making Astral India’s second-largest adhesive brand.

Capacity Expansion: New plants in Hyderabad, Kanpur, and Bhubaneswar aim to reduce logistics costs and improve national distribution.

🏗️ Macro Tailwinds: Infrastructure Boom & Government Support

India’s infrastructure boom adds further tailwind:

₹11.11 lakh crore allocated for infrastructure in Union Budget 2024–25.

Key projects like Smart Cities Mission, PM Awas Yojana, and Housing for All align with Astral’s offerings.

Fire-resistant and OPVC pipes are gaining traction in large-scale government tenders.

Global Growth Potential:

Astral’s international push via its Dubai office, targeting infrastructure projects across Middle East and Africa, strengthens its global presence.

💹 Analyst Confidence & Price Targets

Market analysts reinforced my thesis:

Consensus “Buy” rating with a 12-month target offering 17% upside.

Technical analysts project even higher short-term and long-term targets (up to 65–70% upside) if the 200-day SMA is breached.

The high PE ratio, while expensive on paper, reflects market confidence in earnings growth.

⚠️ Risks to Monitor

No investment is without risks. Here are the key concerns:

Q4 FY25 Profit Pressure: Margins were under pressure due to volatile raw material prices.

UK Adhesives Business: Underperformance acknowledged in the Analyst Meet; recovery expected in 2 quarters.

Valuation Risk: A relatively high beta (1.09) and valuation level suggest potential volatility.

Risk Management: I’ve placed a stop-loss at ₹1,320 — the recent consolidation support — to manage downside effectively.

🧠 Conclusion: A High Conviction Bet

Buying Astral Ltd. at ₹1,410 was a strategic decision backed by:

A solid technical breakout setup

Consistent fundamental performance

Long-term growth driven by policy support and expansion

Clear analyst optimism despite some short-term risks

I remain confident in Astral’s medium- to long-term story, while keeping an eye on earnings updates and price movement relative to the 200-day SMA.

Disclaimer: This article represents my personal investment viewpoint and is not financial advice. Please consult a SEBI-registered advisor before making any investment decisions.

💬 Let’s Talk!

Have you invested in Astral Ltd. or other building materials stocks recently?

What technical or fundamental signals do you consider before entering such stocks?

👇 Drop your thoughts in the comments. Let’s build this investing conversation together!